Bill Luby on VIX-Related Exchange-Traded Products

(Apr 2012)

Bill Luby, who writes at the VIX and More blog and Expiring Monthly: The Options Traders Journal, is one of the most respected voices on all things related to the CBOE S&P 500 Volatility Index, also known as the VIX. We highly recommend anyone interested in the VIX and volatility-related derivates check out his blog, which has a variety of useful analysis and commentary.

Recently there has been a lot of coverage related to TVIX and otherexchange-traded products linked to the VIX. Here at...

Greg Smith Leaves Wall Street

(Mar 2012)

The New York Times published an op-ed by Greg Smith, a Goldman Sachs' Executive Director who is resigning from his job after almost 12 years with the firm because, as he puts it, the firm's culture has veered far from what it was when he first joined the firm. He says in spite of the firm's recent scandals "the interests of the client continue to be sidelined in the way the firm operates and thinks about making money." At SLCG, we have come across many examples of the issues raised by Mr....

WSJ on Innovation in Commodity ETFs

(Mar 2012)

Yesterday the Wall Street Journal ran an article about recent innovation in the commodity ETF space. Our work on commodity ETFs has focused on their use of constant-maturity rolling futures strategies, which incur a roll yield depending on conditions in the futures markets. Now, according to the WSJ, many ETF issuers are choosing more complex strategies to try to mitigate these and other effects in commodities markets:

Some of these new products use complex formulas to identify commodities...

WSJ: Private-Equity Fund in Valuation Inquiry

(Feb 2012)

There is an article in the Wall Street Journal today concerning the alleged exaggeration of an asset's value in a private-equity fund. From the article:

The potential exaggeration in the [Oppenheimer Global Resource Private Equity Fund LP] grew to more than $4 million, according to documents shared with Oppenheimer investors. The bulk of this markup came as the fund was reaching out to potential investors in the fall of 2009, and helped push the fund's reported internal rate of return to 38%,...

Home Equity: Changing Perspectives

(Feb 2012)

We wanted to write a quick post highlight the changing perspectives of industry experts concerning something as mundane as home equity. The LA Times reported in August 2005 that, due to the rapid appreciation of real estate values and perceived wealth accumulation, consumers were beginning to spend more freely. In fact, at the time it was becoming commonplace (and even suggested by experts) to cash out equity in your home to finance otherwise unobtainable, and sometimes transient, purchases...

Could Credit Rating Agencies be Held Accountable This Time?

(Feb 2012)

A recent wall street journal article reports that U.S. lawmakers plan to introduce a bill that would require top credit-rating firms to review their credit ratings on a quarterly basis, hoping that more frequent reviews would increase the accuracy of their ratings and help identify potential problems.

According to Wall Street Journal, the bill would "amend the Securities Exchange Act of 1934 to require the chief executive officer of each [credit-rating firm] to attest, quarterly, to the...

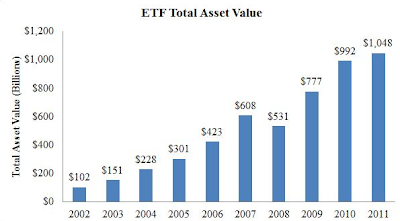

ETFs' Asset Value is Increasing, Trading Volume Remains Stable

(Feb 2012)

Financial Times reports that the daily trading volume in the 50 most traded US ETFs in this January and last December was at its historical lows, dropping to the level of the end of 2007. This is surprising since over the past decade the total asset value of ETFs have increased from its 2002 level of $102 billion to just over $1 trillion in 2011 according to the Investment Company Institute. Below we plot the ETF total asset value over the last decade.

Intuitively, one would expect as asset...

Reserve your Clever ETF Ticker Before it's Too Late

(Feb 2012)

The Wall Street Journal reported yesterday that descriptive and catchy tickers for Exchange Traded Funds (ETFs) are getting harder and harder to come by these days. From the article:

But finding a catchy symbol can be tough these days. Many have already been taken: 1,350 symbols are in use on the NYSE Arca alone, the biggest U.S. market for exchange-traded products. That's up 108% over the past five years, says Ms. Morrison. In addition, fund firms have reserved 2,446 symbols for future...